A better way to calculatehome office tax

Stop under-claiming or guessing. Calculate your home office tax deduction accurately using both HMRC-approved methods and choose the best option for you.

Home office tax is often miscalculated

There are two HMRC-approved ways to claim home office expenses: the simplified flat rate and a detailed calculation based on actual costs. The right choice depends on how you work, how much space you use, and what your real expenses are.

Simple but often leaves money on the table. Great for minimal home use, but most people qualify for more.

Based on actual costs and usage. Usually results in a higher deduction, but requires understanding the calculation method.

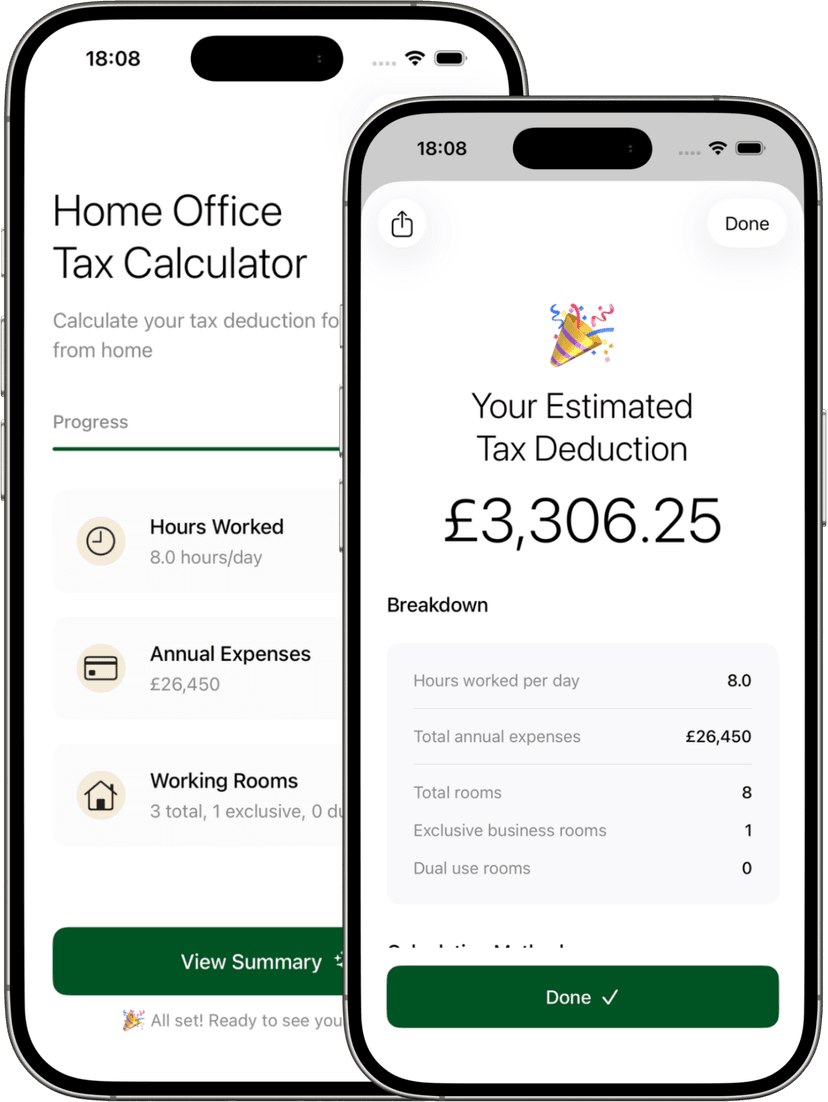

Calculate with confidence

TaxMate does the complex calculations for you and presents everything clearly.

How it works

Get your home office tax deduction in three simple steps

Enter your work pattern

Tell us how many hours per day you work from home. This helps calculate the proportion of your home used for business.

Add your expenses and rooms

Enter your annual household expenses (rent, mortgage interest, council tax, utilities) and specify how many rooms you use exclusively or partially for work.

Get your result

See both calculation methods compared side by side. The app shows you which option is best and explains the difference clearly.

Who is TaxMate for?

Designed for anyone who works from home and completes Self Assessment

Frequently asked questions

No, TaxMate is not affiliated with HMRC. It is an independent app built to help you calculate home office expenses following published HMRC guidance.

TaxMate calculates your deduction based on HMRC's published methods. However, you are responsible for ensuring the figures you enter are accurate and that you retain evidence of your expenses.

TaxMate is designed for self-employed individuals and sole traders claiming expenses through Self Assessment. It is not designed for payroll or corporate expense claims.

No. The app is designed to be simple and clear, even if you're not confident with tax. It asks straightforward questions and explains everything in plain English.

You can create multiple calculations and save them in your history. This lets you compare different scenarios or track changes over time.

Yes. The app provides a clear breakdown of your calculation that you can save or share as needed.

Make your home office tax decision with confidence

Download TaxMate and calculate your deduction in minutes.

Download for iOS